Microloans: why do they matter? Whether dreaming about turning a long-held idea into an exciting business venture or scaling up to meet new demands, an entrepreneur takes one of the most exciting yet challenging pathways by starting or expanding a small business. However, one primary area that helps to fulfill such dreams is funding.

As markets become dynamic and competition stiffer, having the right backup from finances permits one to constantly be on one’s toes, possess all the necessary resources to maneuver any unexpected costs, and stay ahead in spite of all possible troubles that life throws. For an entrepreneur seeking expansion efforts or initiating new programs, small business loans are a steppingstone to a future of stability and growth.

Why Microloans Matter for Entrepreneurs

It takes more than just an idea to start a business. Seed to secure equipment or expand facilities from capital for operations to those larger growth initiatives — indeed, that is the day reality small business loans out here.

The right structure of a loan is what would metabolize aspirations into results. Microloans for many small businesses are not necessarily just survival tools – they are opportunity tools and the tools for creating a different future from that of the competitively challenged.

Here are some ways in which microloans can help develop your business:

- Operational Expansion – Upgrading facilities or expanding office space.

- Technology Investments – Purchasing updated software, hardware, and tools essential for productivity.

- Marketing Campaigns – Promoting products and services to reach new audiences.

Key Benefits of Microloans for Small Business in 2025

In 2025, microloans are emerging as a vital financial resource for small businesses and entrepreneurs eager to expand, innovate, and sustain their ventures. As economic landscapes shift and competition intensifies, the ability to secure quick and manageable funding can make the difference between growth and stagnation. Microloans fill this gap by offering accessible and flexible solutions that are specifically designed to meet the unique challenges faced by small business owners.

Unlike traditional financing options, microloans cater to businesses that may not qualify for larger loans, providing them with the capital needed to invest in equipment, increase inventory, or cover short-term operational costs. This adaptability makes microloans not only a lifeline during difficult periods but also a springboard for future growth and expansion. As a result, microloans continue to empower entrepreneurs, fostering innovation and driving economic resilience across various industries.

Some of the key benefits include:

- Flexible Loan Structures – Microloans can be customized to align with business cycles, ensuring repayments fit revenue flow and seasonal fluctuations.

- Fast Access to Capital – With simplified processes, microloans are often approved and disbursed quickly, allowing businesses to address immediate needs or seize opportunities.

- Reduced Financial Risk – Microloans serve as a buffer against unexpected expenses or cash flow gaps, helping businesses maintain stability during uncertain times.

Things to Consider Before Applying

Microloans are advantageous to a large extent; but proper preparation is requisite to exploit them most effectively.

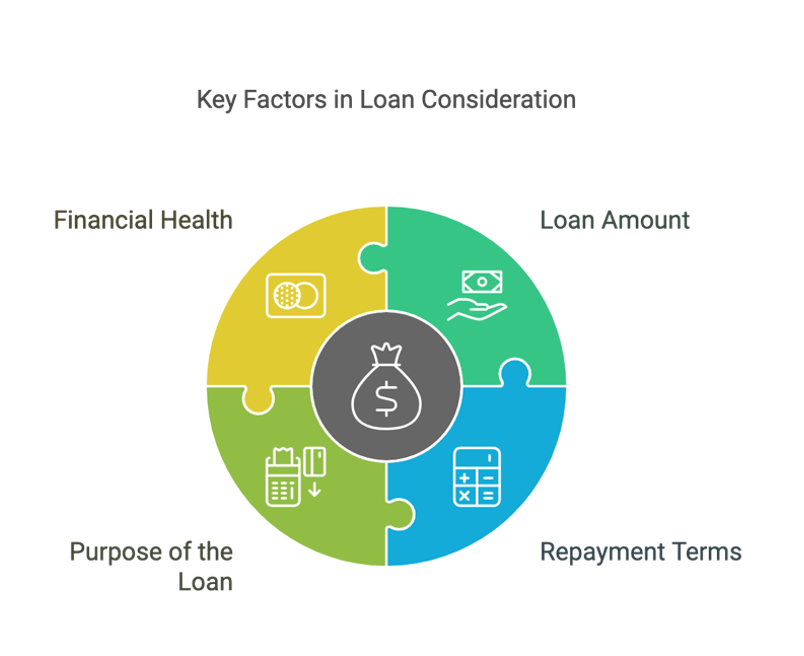

Key Factors to Consider:

- Loan Amount – Clearly define the amount needed to avoid over-borrowing or underfunding your project.

- Repayment Terms – Evaluate repayment schedules and interest rates to ensure they fit within your cash flow.

- Purpose of the microloan – Outline specific uses for the funds, whether it’s for equipment, staff, or expansion.

By carefully assessing these areas, entrepreneurs can make informed decisions that lead to sustainable growth.

How PSPXpress Can Support Small Businesses

PSPXpress recognizes the dedication and passion with which entrepreneurs pour themselves into their businesses. We want to make microloans accessible and flexible, as we believe this is the pathway to growth and success.

Whether you require funding for expansion, investment in technology, or the day-to-day running of your business, our microloans have been designed with those needs in mind. We pride ourselves on quick approvals, total fair play, and loan structures that work with your business, not against it.

👉 Apply Now and Take the Next Step in Your Business Journey

Your business is more than just numbers—it’s a vision. Let us help you bring that vision to life in 2025 and beyond.