When financial needs arise, speed and simplicity often become the top priorities. Whether you’re facing unexpected expenses, seizing a business opportunity, or just need a cash boost, quick loans can provide the solution you need – fast. At PSPXpress, we understand that waiting weeks for a traditional loan isn’t always an option. That’s why quick loans are becoming the go-to choice for individuals and businesses alike.

If you’re wondering whether quick loans are the right fit for you, let’s break down three key reasons why they outperform traditional loans in many situations.

1. Faster Approval and Access to Funds

One of the biggest advantages of quick loans is, unsurprisingly, the speed at which you receive the money. Traditional loans often involve long processing times, extensive paperwork, and multiple approval stages. This can result in delays that could jeopardize your plans or cause unnecessary stress.

Quick loans, on the other hand, streamline the entire process. Many applications can be completed online in just a few minutes, with decisions made almost instantly. Once approved, funds are typically deposited into your account within 24 to 48 hours. This rapid turnaround makes quick loans the ideal choice for emergencies or time-sensitive opportunities.

At PSPXpress, we pride ourselves on providing fast, hassle-free approvals that allow you to focus on what matters most.

2. Simplified Application Process

Applying for a traditional loan often feels like a marathon of paperwork and documentation. From proof of income to credit history and detailed financial reports, the list of requirements can be overwhelming. Even after submitting everything, there’s no guarantee of approval.

Quick loans eliminate much of this complexity. The application process is designed to be simple and straightforward, often requiring just a few key details such as your ID, proof of income, and bank account information. Some quick loans even cater to individuals with less-than-perfect credit, offering greater accessibility than traditional banking systems.

By choosing PSPXpress, you skip the unnecessary paperwork and avoid the tedious back-and-forth. We make borrowing simple, ensuring you get what you need with minimal effort.

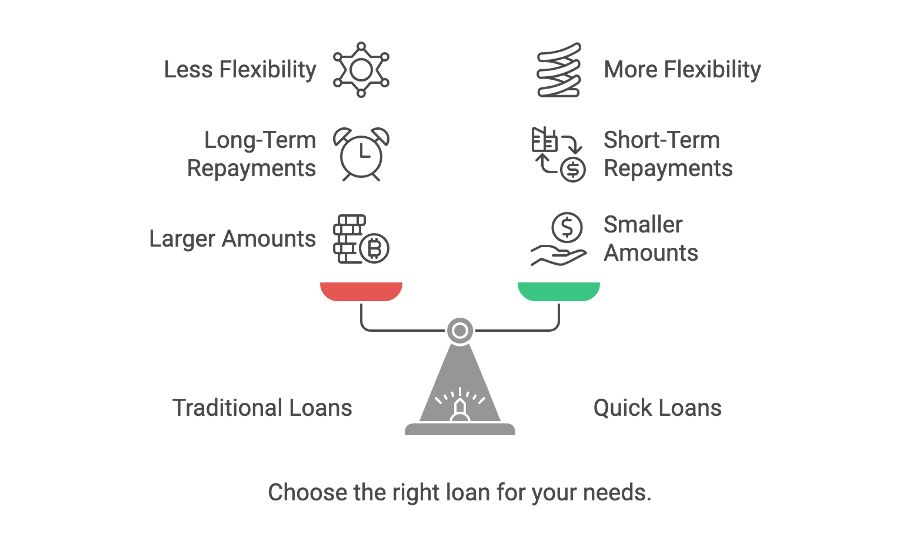

3. Flexibility and Smaller Loan Amounts

Traditional loans are typically structured for larger amounts and long-term repayments. While this might be suitable for major investments or mortgages, it can be excessive for smaller financial needs. Quick loans, however, offer more flexibility by allowing you to borrow smaller amounts that match your immediate requirements.

This flexibility prevents unnecessary debt accumulation and allows you to repay the loan faster. Whether you need to cover unexpected car repairs, medical bills, or short-term cash flow issues, quick loans provide just the right amount without tying you to long repayment periods.

At PSPXpress, we offer customizable loan options that fit your situation perfectly, ensuring you borrow only what you need.

How to Get Started with a Quick Loan

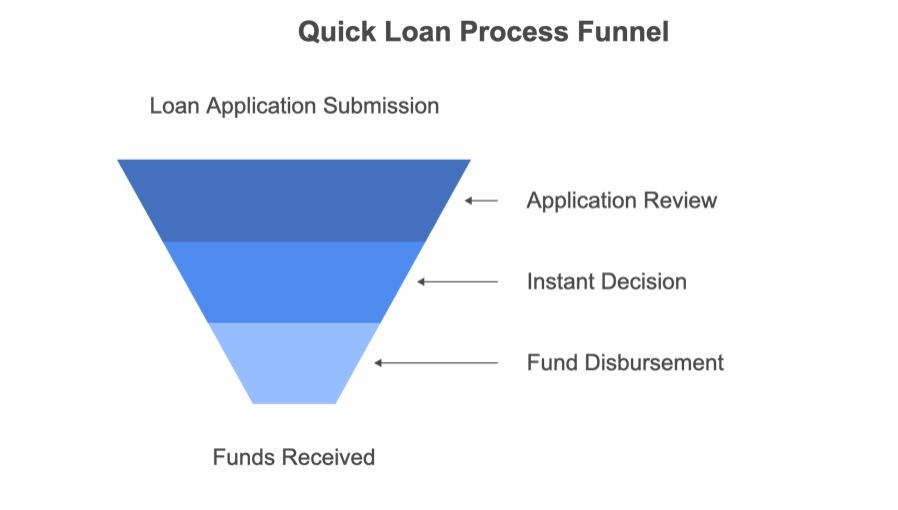

Choosing a quick loan is simple and can be broken down into three easy steps:

- Apply Online – Fill out the simple application form on our website in just a few minutes.

- Get Approved – Receive approval within hours, with minimal documentation required.

- Access Funds – Get the money deposited directly into your account, usually within 24 to 48 hours.

What our clients say about us!

“PSPXpress saved the day when I needed to cover unexpected medical expenses. The application process was quick and straightforward, and I had the funds in my account the next day. Highly recommend their service.”

– Lisa M., PSPXpress Customer

Don’t Wait – Get the Funds You Need Now

When speed and simplicity matter, quick loans are the smarter choice. Whether you’re managing a personal emergency or a business opportunity, PSPXpress is here to provide the financial support you need – without the hassle.

👉 Apply now and experience fast, reliable loan services with PSPXpress